Kundeninformationen

Ein B2B-Unternehmen mit Sitz in Großbritannien hat Andersen kontaktiert. Die Organisation bietet transparente Zahlungs- und Transaktionsmanagement-Lösungen an, die auf juristische und professionelle Dienstleistungen ausgerichtet sind. Diese Lösungen erfolgen über eine benutzerfreundliche Plattform für Mass Payouts.

![[object Object] on the map](https://static.andersenlab.com/andersenlab/new-andersensite/bg-for-blocks/about-the-client/united-kingdom-desktop-2x.png)

Projektdetails

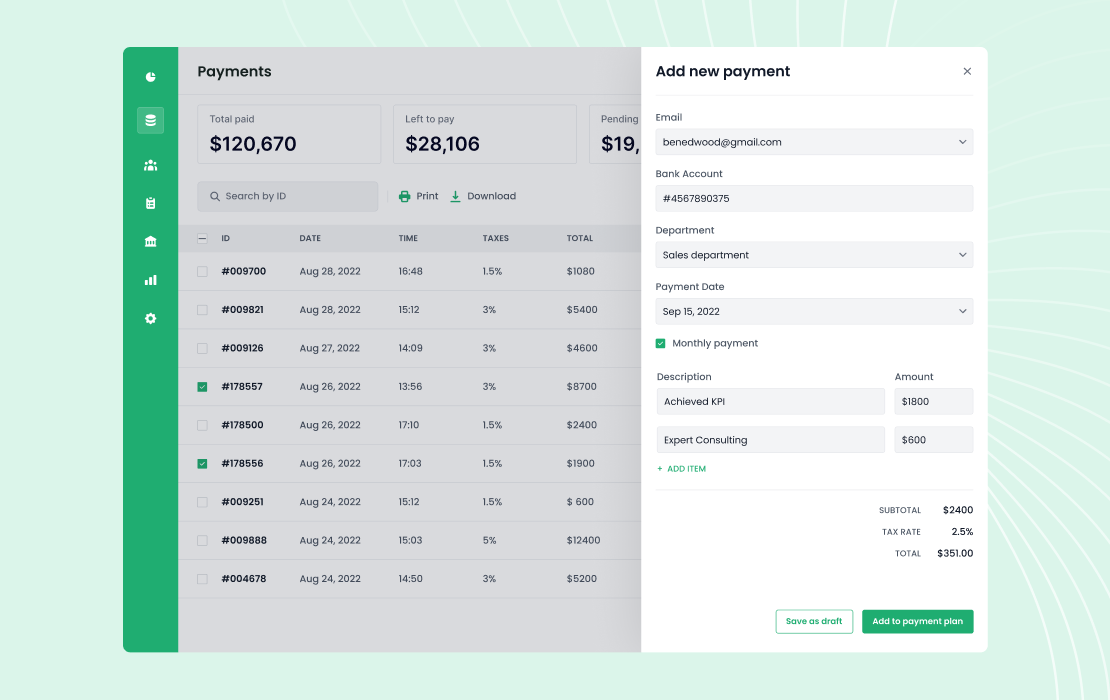

Eine Multiprodukt-Plattform für ereignisbasierte Auszahlungen, die sowohl von Unternehmen als auch von Privatpersonen genutzt werden kann. Sie gewährleistet sichere Zahlungen, sowohl technisch als auch in Bezug auf den Ruf.

Geschäftsidee

Der Kunde hat uns kontaktiert, da Andersen als zuverlässiger IT-Anbieter bekannt ist. Unsere Aufgabe bestand darin, eine Plattform für Mass Payouts zu entwickeln, die es Kunden in verschiedenen Branchen ermöglicht, schnelle und einfache Batch-Zahlungen durchzuführen, darunter globale Versicherungsauszahlungen, Finanzdienstleistungen, weltweite Rentenzahlungen und Auszahlungen im Rechtsbereich.

Die Plattform soll den Betriebsablauf vereinfachen, indem sie es ermöglicht, mehrere Auszahlungen für Einzelpersonen und Unternehmen mit nur einer Aktion durchzuführen

Die resultierende Lösung ermöglicht eine Vielzahl von Mass Payouts, darunter Rabatte, Gewinne, Provisionen, Belohnungen und Anreize. Unternehmen, die Gelder lokal oder weltweit auszahlen müssen, können nun von schnellen Sammelzahlungen an mehrere Empfänger profitieren, unabhängig von deren Standort oder der verwendeten Währung.

Projektumfang

- Migration bestehender Produkte auf eine neue Multi-Produkt-Plattform;

- Entwicklung einer Vielzahl neuer Produkte;

- Automatisierung von Compliance-Check-Journeys.

Architektur

- AWS Lambda-Funktionen und ein serverloses Framework zur Skalierung spezifischer Funktionen und zur Optimierung von Kosten;

- Ereignisgesteuerte Architektur unter Verwendung von EventBus, basierend auf SNS und SQS, zur Entkopplung mehrerer Domänen und Microservices;

- Datenanalyse mit einem Amazon S3-Data-Lake und AWS Kinesis;

- E2E-Tests mit Cypress und Cucumber;

- Leistungstests mit Artillery;

- Ein API-First-Ansatz mit sowohl internen als auch externen API-Gateways und dem BFF-Muster zur Entkopplung und Trennung verschiedener Anliegen.

Plattform-Funktionalität

- Onboarding und Verifizierung von Geschäftspartnern (KYC, KYB, AML, etc.);

- Fondsverwaltung;

- Abgleich;

- Abwicklung von eventuellen Auszahlungen;

- Unterstützung für Zahlungen über virtuelle Karten;

- Mass Payouts (der Durchsatz liegt bei über 500.000 Transaktionen pro 15 Minuten);

- Berichterstattung und Analyse;

- Admin-Portal;

- Externes Benutzerportal;

- Überwachung der App-Ladezeit, Reaktionsfähigkeit, Absturzraten usw.;

- Sicherstellung der Kompatibilität über verschiedene Gerätetypen, Bildschirmgrößen und Betriebssysteme hinweg.

Projektergebnisse

- Prozessautomatisierung, was zu einer erheblichen Zeit- und Aufwandsreduzierung für die Bearbeitung von Anwendungsfällen geführt hat;

- Erfolgreiche Umsetzung des MVP.

Kostenlose Beratung anfordern

Weitere Schritte

Nachdem wir Ihre Anforderungen analysiert haben, meldet ein Experte bei Ihnen;

Bei Bedarf unterzeichnen wir ein NDA, um den höchsten Datenschutz sicherzustellen;

Wir legen ein umfassendes Projektangebot mit Kostenschätzungen, Fristen, CVs usw. vor.

Kunden, die uns vertrauen: