Der Kunde hat beschlossen, seine vertraulichen Daten zu schützen

Digitales Banking für B2B2C

Kundeninformationen

Andersens Kunde ist ein FinTech-Anbieter, der auf Einfachheit, Transparenz und faire Kosten setzt. Das Unternehmen bietet eine geschäftsorientierte BaaS-Plattform für die Finanzbranche und ist vollständig gemäß den europäischen Vorschriften reguliert. Sein erfahrenes Team engagiert sich voll und ganz, um die Ziele seiner Kunden im Finanzdienstleistungssektor zu erreichen.

![[object Object] on the map](https://static.andersenlab.com/andersenlab/new-andersensite/bg-for-blocks/about-the-client/germany-desktop-2x.png)

Projektübersicht

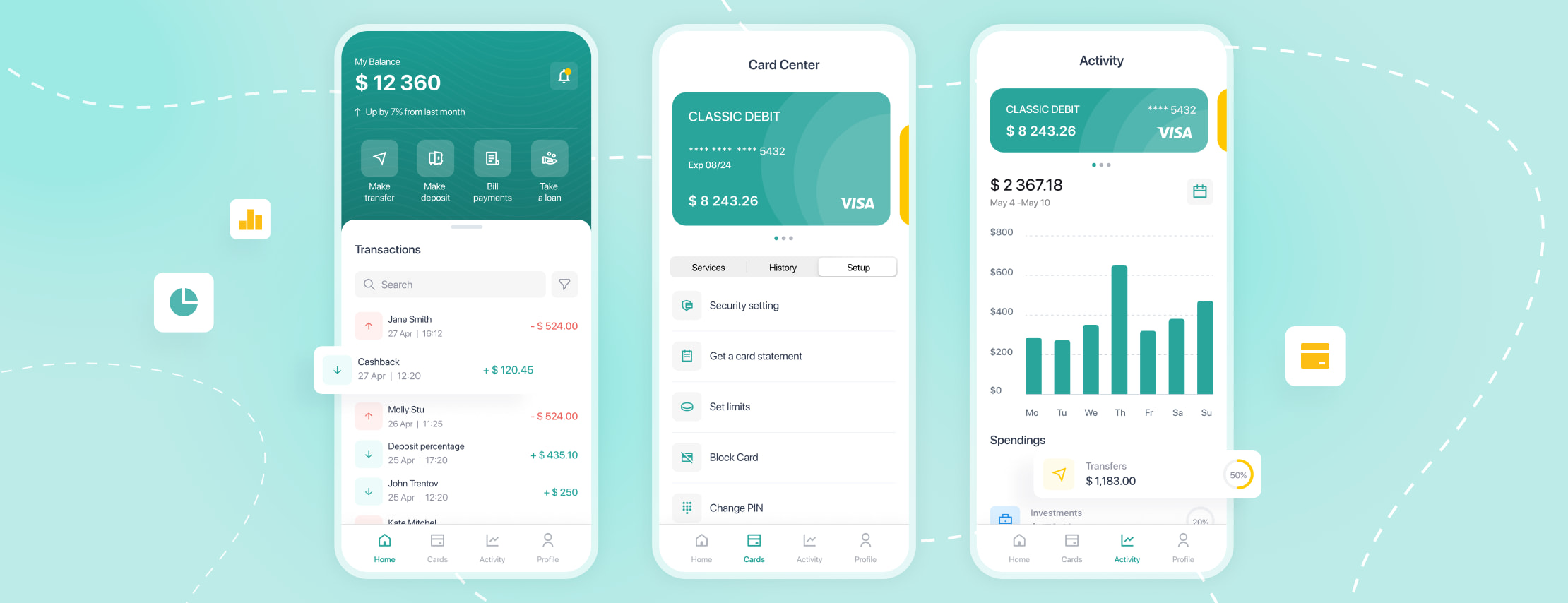

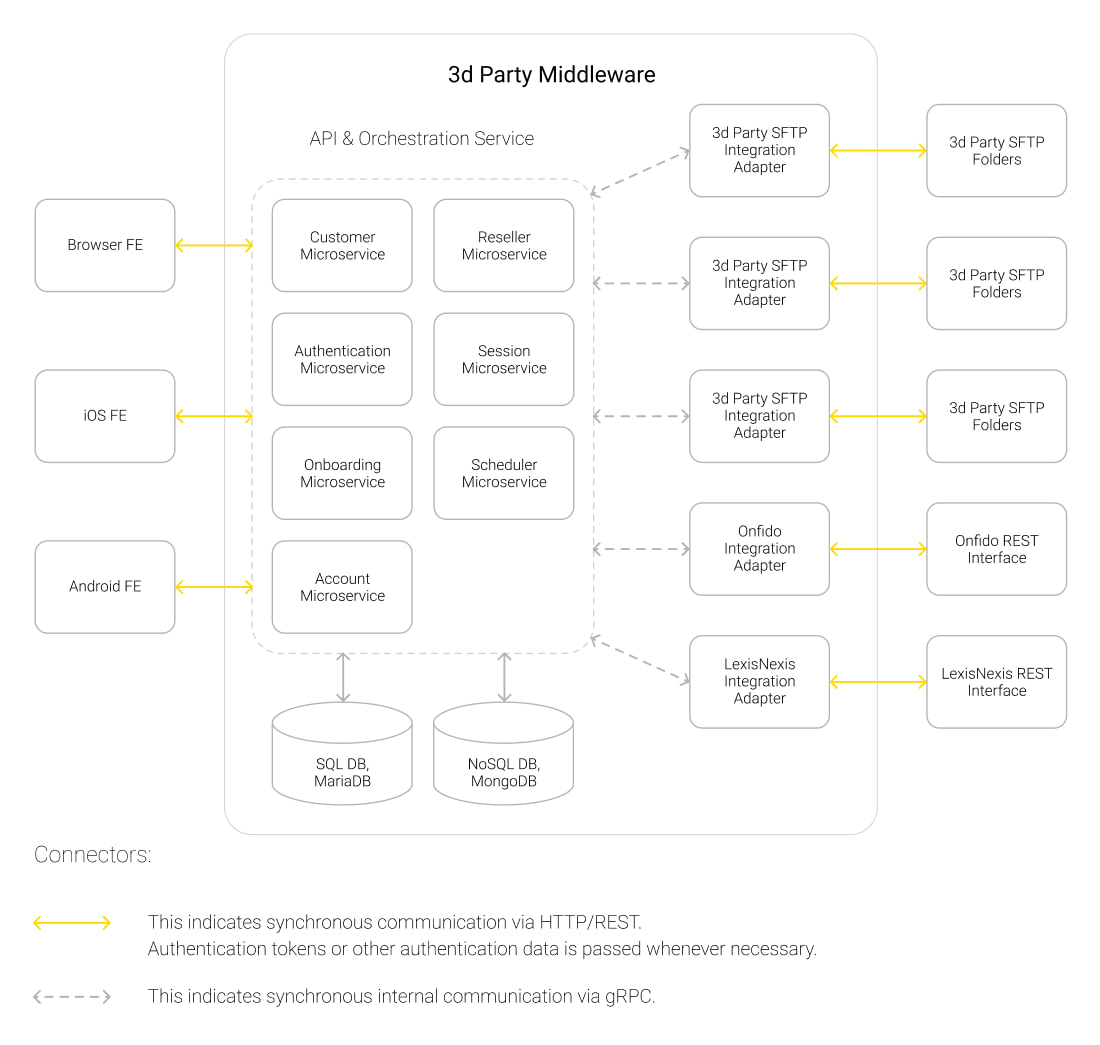

Andersen, mit einem umfangreichen Talentpool für die Entwicklung von Banking-Lösungen, wurde von einem europäischen FinTech-Unternehmen beauftragt, eine Banking-as-a-Service-Plattform für seine Geschäftskunden aus der Finanzbranche zu entwickeln. Das Projekt wurde in Deutschland durchgeführt, dauerte 11 Monate und nutzte Technologien wie Java, Spring und React. Ziel war es, eine zuverlässige Grundlage zu schaffen, damit die Kunden des FinTech-Unternehmens Finanzdienstleistungen über ihre eigenen Plattformen anbieten können. Andersen entwickelte eine Unternehmens-App und eine API-Plattform, die mit Kernbankensystemen und Diensten Dritter integriert sind. Die Lösung deckt den gesamten Geschäftszyklus ab und beinhaltet KYC- sowie AML-Prozesse.

Ein typischer Kunde der neuen Banking-as-a-Service-Lösung ist ein Unternehmen mit einer großen Benutzerbasis, das Finanzdienstleistungen über digitale Kanäle anbietet.

Diese Plattform, die im Rahmen des Banking-as-a-Service geliefert wurde, sollte den Kunden des Auftraggebers aus verschiedenen Segmenten eine verlässliche Grundlage für ihre Aktivitäten bieten und ihnen ermöglichen, über ihre digitalen Lösungen verschiedene Dienstleistungen für ihre Endbenutzer anzubieten. Anders gesagt, es war geplant, die Front-End-Lösungen der Kunden des Auftraggebers mit der zentralen Middleware zu verbinden, deren Entwicklung ebenfalls unserem Team anvertraut wurde.

Projektanforderungen

- Daten geschützt durch SSL-Technologie;

- Nahtlose Zahlungen, die durch die Failover-Fähigkeit weltweit sichergestellt sind;

- Echtzeit-Zahlungen;

- Bankkonten und digitale Geldbörsen;

- Vollständige Compliance, einschließlich AML und KYC;

- Zuverlässige und sichere Onboarding-Prozesse, die auf mehrstufigen Prüfungen basieren.

Geschäftsidee

Unsere Aufgabe bestand zunächst darin, eine mobile Unternehmens-App und eine API-Plattform – also Middleware – zu entwickeln. Zudem benötigte der Kunde zuverlässige Integrationen mit den Kernbankensystemen, Referenzbanken, dem Online-Banking-Frontend sowie verschiedenen Drittanbieterdiensten, Softwaremodulen und Systemen.

App-Funktionalität

Andersen hat erfolgreich die Lösung für den gesamten Geschäftszyklus des Kunden geliefert. Dieses Produkt deckt alle Aspekte der Kundeninteraktion sowie die Interaktion zwischen den Kunden und ihren Endbenutzern ab.

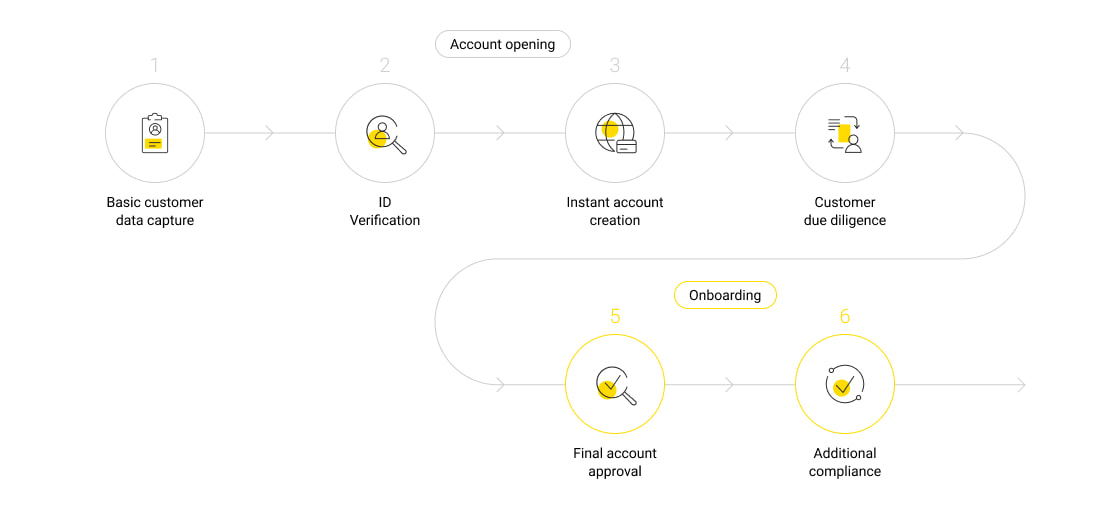

Onboarding

- Identitätsprüfung der Kunden;

- ID-Erfassung und Selfie-Validierung;

- Bestätigung per E-Mail;

- Bestätigung per Telefonnummer;

- Erfassung und Validierung der Unterschrift;

- Erstellung der Richtlinien.

Kontoaktivierung

- Nahtlose Kontoeröffnung über andere Produkte des Kunden;

- Generierung von KYC-basierten Online-Banking-Anmeldeinformationen.

Aktivierung von Dienstleistungen

- Ausgabe und Aktivierung von Debitkarten

- Verfahren zur Kundenakquise

Kontoeröffnung

- Erfassung grundlegender Kundeninformationen;

- ID-Prüfung und -Verifizierung;

- Endgültige Genehmigung der Konten;

- Zusätzliche Compliance-Funktionen, einschließlich typischer Ausgabemuster und Transaktionsarten.

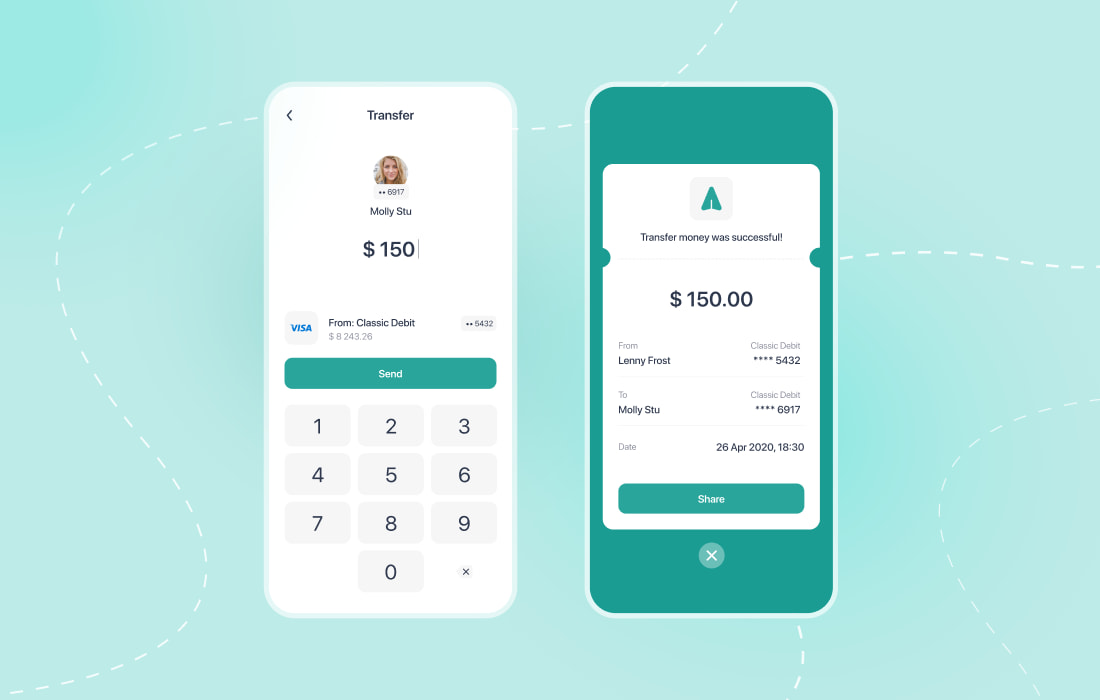

SEPA- und SWIFT-Integration

- SEPA-Zahlungsintegration für mehr Effizienz bei grenzüberschreitenden Zahlungen in der Eurozone;

- SWIFT-Zahlungsintegration für weltweite Währungsüberweisungen.

KYC- und AML-Integration

- KYC-Prozesse zur Identifizierung der Kunden, Überwachung ihrer Transaktionen, Risikominderung und Verhinderung von Bestechung und Korruption;

- Eingebettete AML-Compliance zur Meldung verdächtiger Aktivitäten, Führung von Aufzeichnungen, Überwachung von Geldflüssen usw.

Projektergebnisse

- Die native Online-Banking-App hat in den ersten sechs Monaten 31 % mehr Kunden gewonnen;

- Die mobile App und die API-Plattform auf Unternehmensniveau decken den gesamten Geschäftskreislauf ab;

- Zuverlässige Onboarding-Prozesse wurden vollständig implementiert, einschließlich Kundenvalidierung, ID-Erfassung und Richtlinienerstellung;

- Die optimierte Kontoaktivierung ermöglicht einfache Kontoeröffnungen sowie die Ausstellung und Aktivierung von Debitkarten.

Kostenlose Beratung anfordern

Weitere Schritte

Nachdem wir Ihre Anforderungen analysiert haben, meldet ein Experte bei Ihnen;

Bei Bedarf unterzeichnen wir ein NDA, um den höchsten Datenschutz sicherzustellen;

Wir legen ein umfassendes Projektangebot mit Kostenschätzungen, Fristen, CVs usw. vor.

Kunden, die uns vertrauen: