- 1. Development of the concept for digital transformation

- 2. Implementation of smart IT-system architecture

- 3. Focus on the development of revenue-generating channels.

- 4. The wide use of accumulated data

Refresh your memory of such corporations as Kodak, Nokia, and Xerox. In a fairly short time, their market share plummeted and they weren’t able to recover for a long while. And all this happened in the good old days. There are many reasons for their decline, but a key one is that they missed the very moment when the market and their customers’ needs changed, unlike their competitors who started relying on new technologies and innovations.

The corona crisis signaled clearly: businesses must be able to instantly adapt to changes, no matter how insuperable they may seem. And, by the way, transferring tens of thousands of employees to remote work within a matter of days proves that anything is possible.

It used to feel like the evolution of customer behavior and the speed of technological changes in banking were incredibly fast. However, the global lockdown immediately revealed sensitive spots, indicating the imperfection of business processes and technological immaturity. Nowadays, many banks seem vulnerable, like those above-mentioned giants at that key moment.

Obviously, banks should be going digital; that is not even a question. The question is how to do it correctly and more rapidly than competitors. Each case is unique, of course, but in our opinion, there is one key detail - the Client.

The client should be at the center of the bank’s digital transformation, and all changes should focus on their needs and wants. Of course, a little consideration is also given to the convenience of the staff and the satisfaction of shareholders’ ambitions.

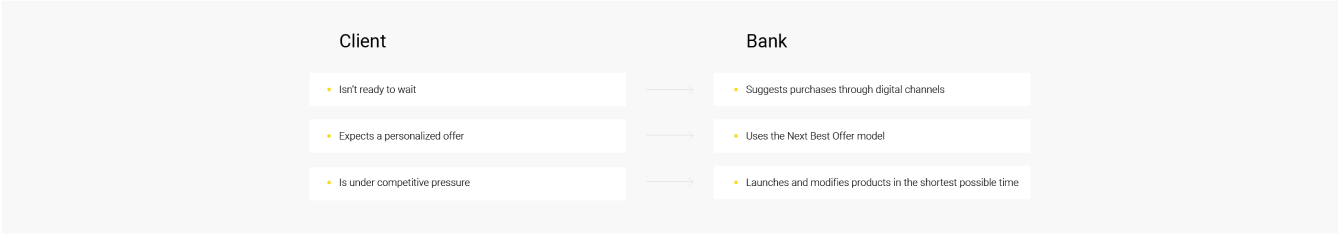

A modern client of a bank can be characterized by several features that determine their consumer behavior:

- The client is not ready to wait → The bank should provide the opportunity to purchase the largest possible number of products, including complex ones (for example, mortgages) through digital channels, eliminating the necessity to visit the branch or reducing the number of such visits as much as possible;

- The client expects a personalized offer → The bank should use the Next Best Offer model (NBO) which is based on a 360 view of the client, the development of NBO algorithms (AI and ML), and the automation of marketing campaigns;

- The client is under constant competitive pressure → In order to keep the client, the bank should provide them with not only excellent service and user experience but also an in-demand service. The launch and change of products should take weeks but not months, and this is possible with the proper level of product system flexibility and the presence of common scenarios for all front systems.

For traditional banks that haven’t got better at priorities of the digital transformation of their businesses, the time to make a decision has come: to go digital or stand idly by and slowly lose clients and, in the end, their businesses.

We analyzed and identified the key factors, which helped advanced banks go through or make significant progress in matters of the digital transformation of their businesses. Banks which have reached decision time need to consider these factors:

1. Development of the concept for digital transformation

Making the bank “just a little bit digital” won’t work; this will be a lot of effort for not only and not so much the IT department but also all business units.

According to research, half of the world`s banks are making meaningful progress in digital transformation, but only 12%¹ of these banks precisely adhere to this strategy, which ultimately reflects in their higher rates of return on capital.

Given the dynamics of changes in banking, it does not make much sense to develop long-term concepts. In current conditions, it is better to choose a 3-5 year period (depending on the scale of the changes), with subsequent refinement and updating of the concept at least once every six months.

When preparing the concept, emphasis should be given to the transformation of the bank’s business processes and IT, as well as to how these key blocks will interact with each other.

When analyzing the changes taking place in the industry, we have noticed that banks that have achieved significant success in the digital transformation of their businesses are more akin to technology companies than classical financial organizations. If this trend is followed, there will be a release of personnel from service units due to the automation of processes, as well as an increase in the significance of the role and number of developers, Big data specialists, and Cloud engineers. This trend should be reflected in the concept.

2. Implementation of smart IT-system architecture

IT architecture is a digital skeleton for a bank. The main tasks that the new architecture has to solve are the maximum reduction of the time for launching a new product/feature on the market (time to market) and ensuring the unity of all business processes for the user in all channels. What makes such an architecture smart is the weak cohesion of components, integration on the basis of business processes, and the adequate cost of subsequent support, as well as leaving the possibility for subsequent scaling.

Many banks are still relying on the use of legacy systems that are usually monolithic systems with a large number of internal connections and interdependencies between components.

Many of them are pretty functional and stable, but more and more business scenarios are appearing, which have to be addressed in ways those systems were not originally intended for. For example, the degree of interconnection between internal components in legacy systems is such that compliance with the regulator’s requirements like providing OAPI for access to clients’ accounts requires the intervention of a solution provider, which increases the cost and time expenditure for the task completion.

According to analysts’ forecasts, by 2023, 65%² of enterprises will be in the transition phase from legacy systems to new technology platforms.

In this regard, there are two approaches to such a transition: a relatively fast one and a slower (evolutionary) one. The first approach requires greater organizational readiness, significant investment during initial stages; it is appropriate when the time for changes is limited. The second one caters to a smoother transition by maintaining part of the legacy systems at the first stage and gradually replacing them at the next stages.

Whichever approach you choose, you are likely to come up against a choice between microservices, service-oriented architecture (SOA), or a hybrid option.

Many consider the microservice approach as the only correct architecture, but such granularity of services doesn’t make sense in all cases, considering the size of the business and the peculiarities of maintaining such an architecture. It would be more correct to say that in each particular case, the type of solution should be determined by the expected result and deep analysis. Our experience suggests that elements of SOA and microservice approaches can be combined with a legacy monolith. At the same time, an approach focused on weakly cohesive components (microservices and SOA) gives more freedom in choosing programming technologies and facilitates integration. However, some difficulties arise because a particular business process usually affects several systems, which leads to an increase in the number of microservices. This, in turn, leads to an increase in the volume of integration and the cost of maintaining individual databases and synchronization, which affects the size of the DevOps team accompanying the process.

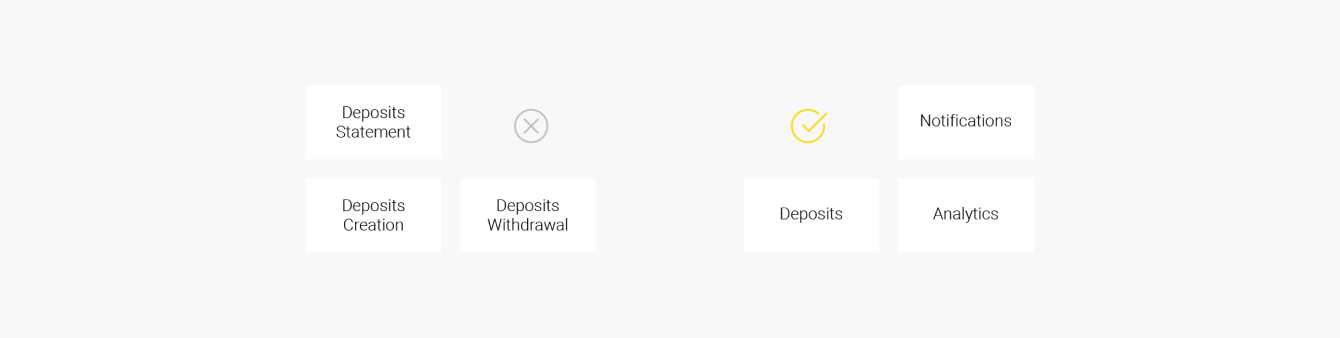

An example of the incorrect use of the microservice approach can be the creation of separate microservices for deposit functionality (opening a deposit, withdrawing a deposit, receiving a statement of a deposit).

Opening, withdrawing, receiving a statement - all this is quite strongly connected data, and there is no point in conducting operations in different services.

In this example, working with deposits should be considered as an independent service, and we can add notifications about income/expense transactions via SMS/messenger app/email or analytics of client operations as other independent services.

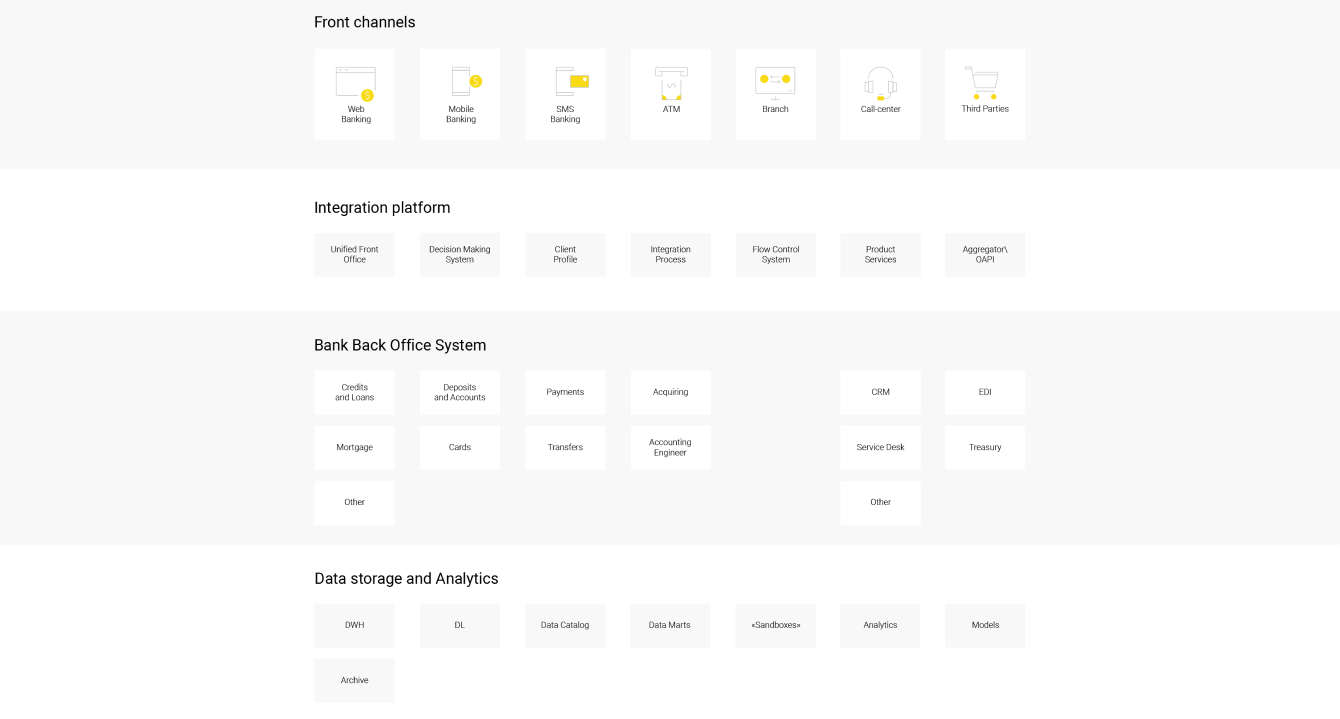

The scheme below shows a variant of the upper-level architecture for a modern bank as we see it.

When dealing with digital transformation projects at Andersen, we often face an evolutionary approach, when it is necessary to replace only the critical part of the legacy kernel for further re-engineering without damaging the work of the entire system. After the analysis stage, we offer a set of architectural schemes where we focus on creating:

- Convenient front-end (mobile and web);

- A single integration layer for front-end solutions (website, mobile application, third-party consumers, cash desk, operator’s workplace, operational accounting);

- A single business component space;

- Integration layer to isolate the legacy system.

When creating an integration layer, we try to make it as reusable as possible when implementing the next stages of back-office modernization.

In the next stage, part of the core logic is isolated and becomes available only through the API. Microservices are allocated and a proxy service is developed to receive data from both the legacy system and new services, as well as to provide limited access to the legacy system. Then, the business logic from the legacy monolith is completely replaced by the created microservices.

3. Focus on the development of revenue-generating channels.

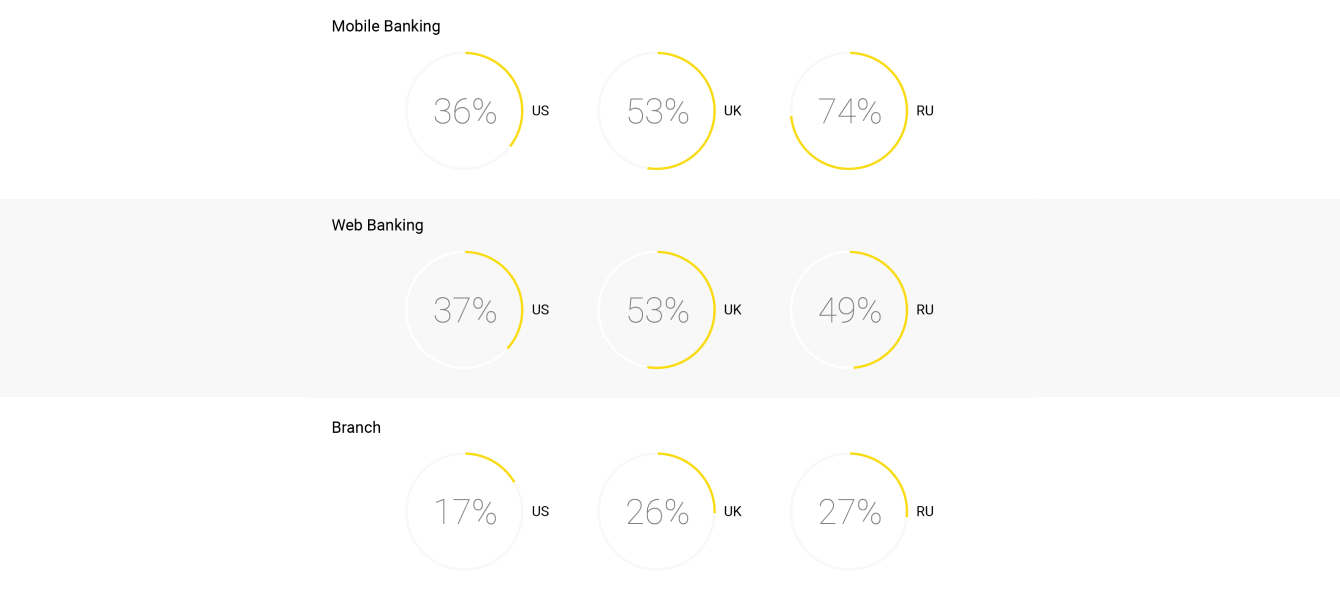

We gathered information on the frequency of use of the main customer service channels from various sources for 2019 for the USA, UK, and Russia.

The picture shows that there are significant differences between the regions. Despite the fact that the top banks` figures on the use of channels may vary significantly, on a country scale this effect is blurred. For example, Wells Fargo (the 4th largest US bank) recently noted that 75% of clients use a mobile application to carry out the vast majority of transactions, while the national average is only 36%.

The key conclusion that can be drawn is that the mobile channel has already surpassed all other channels in terms of frequency of use. At the same time, the online channel and branches are still in demand, but mainly when it comes to more complex tasks, such as foreign transfers, purchase of investment products, mortgages, etc.

The transition to the mobile-first strategy is absolutely justified, as our society can surely be called smartphone-dependent.

Despite the fact that at the beginning of 2020, many studies noted the importance of bank branches for clients, the outbreak of Covid-19 will make changes and the trend for closing offices will intensify. We believe that over the next 5 years, most of the bank branches in developed countries will turn into branches with consultants instead of operation specialists, and they will be replaced by video call centers that, with the development of audio and video authentication services, will allow the performance of any operations.

In order for your application for mobile and web banking to be considered modern, it is no longer enough just to attach a card and be able to make payments and transfers. Below are the features that we included in our checklist to determine the maturity of a daily banking application:

- Authentication using biometrics

- QR payments

- Payment subscriptions

- Integration with Apple Pay, Google Pay, and Samsung Pay

- The ability to receive cashback and accumulate loyalty program bonuses

- Transfers by phone number and social media

- Ability to set goals for savings

- Custom spending reports

- Advanced SMS/push notifications (Bills coming due, Low balance/overdraft risk, Large purchases, Certain categories of purchase, Password/profile change)

- AI chatbot with the bank

- Account statements with a detailed transcript of transactions

In terms of application functionality at Andersen, we have noted the following trends in mobile and online channels:

- Simplification of payments and transfers (auto payments, subscriptions to accounts, auto payment of taxes and fines, templates);

- Binding cards of other banks in the application and the ability to use them;

- Creating virtual cards;

- Wide possibilities for customizing the user`s desktop;

- Filtering and end-to-end search for payments, beneficiaries, periods, etc.;

- Setting limits for payments, considering the location, channels used, etc.;

- Development of marketplaces with a financial core and an increasing number of services that are not traditional for banks.

Another element that is important for the development of digital channels is usability. In terms of functionality and the availability of certain features, mobile or web applications of banks are very similar. The key factor is the user experience of the interaction, usability, and ease of operation. It is impossible to constantly add newer and newer functionalities and products, therefore, market leaders are now more likely to reflect in order to further simplify the experience of interaction and more convenient organization of application elements.

When creating functionality at the UX stage, we get statistical and analytical data from both the user audience and the business. All the data obtained is tested by our experts, and only after research when there is an approved dynamic prototype, do we proceed to create a system design that allows you to get a competitive product.

4. The wide use of accumulated data

It is necessary to think about the use of data at the concept stage, and certainly at the stage of creating the architecture.

Advanced banks have long launched projects to create infrastructure for working with Big Data, including “data lakes” and in-memory data.

Customer data and data on the history of their interaction with the bank are not of high value, but in combination with AI and ML technologies, they allow creating strategies and changing banking products based on reliable information, as opposed to blindly. Such an opportunity arises only in conjunction with investments in Big Data infrastructure and a team of specialists for migration and gain of useful data.

In 2019, 22% of the banks in the world have already started using AI, RPA, ML tools, and 36% are in test use mode (according to Deloitte).

At the same time, according to Statista, by 2023, the total effect of the use of AI in banking will have caused 72% growth which amounts to $126 billion.

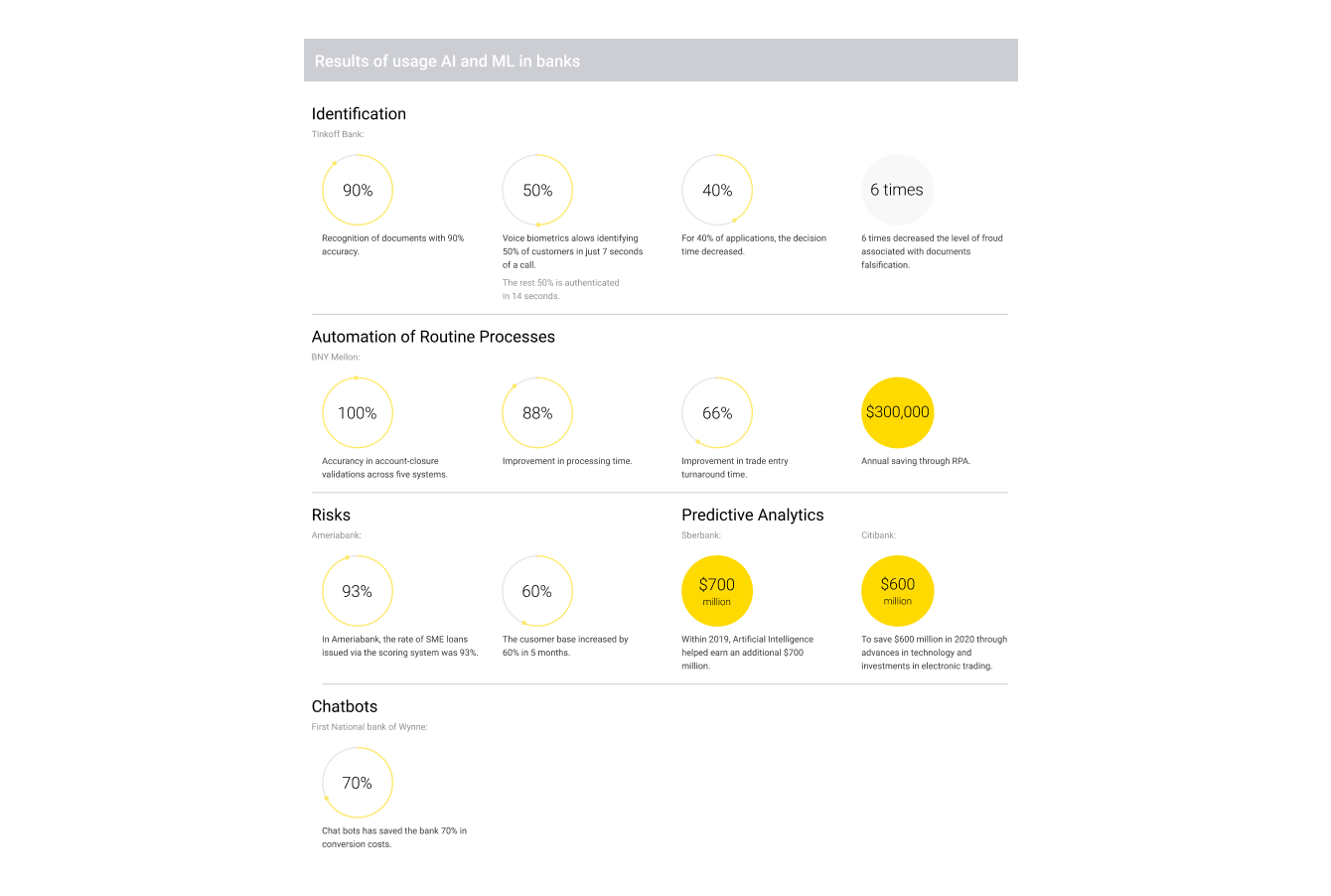

In the diagram below, we tried to make a generalization to show that for many banks, working with data has already become a regular routine process, which helps to achieve impressive results.

As a summary, we would like to note some observations:

- Many banks, for example, American ones, still use Cobol-based systems, which are more than 40 years old. In the midst of a corona crisis, many US government agencies were forced to turn to the market to attract Cobol developers to solve the problem of the increased load on their software. The problem is that there are very few such specialists and most often they are already retired. To avoid such troubles, banks should have thought about upgrading their IT as early as yesterday.

- Banks that keep pace with the times become more like IT companies than banks (BBVA, Revolut, Tinkoff, etc.). This trend surprisingly works in the opposite direction - technology companies become banks. Here we can note a number of Asian players: Wechat, Alibaba, Grab and global companies like Amazon, Apple, Google, and Uber. This only increases competition in the market, which means that we will still have many innovations in the fight for the client.

- There are a lot of people working in banks. For example, the top 10 banks in the world alone employ 2.5 million people. The digital transformation will affect all these people without exception. The banks should explain to their employees, and the employees should understand the fact that technological innovations will require changes in many business processes, otherwise such changes are useless.

- From the point of view of functionality, banks that have chosen the path to develop their marketplaces based on Open API technologies will be leading the charge in the next few years. Clients can use the services of bank partners and get an unlimited amount of opportunities in one banking application. This includes the possibility of purchasing insurance and investment products, tickets and permits, appointments with a doctor, calling a taxi, etc. This will lead to the user needing a significantly smaller number of applications on their smartphone.

- What is important for implementing digital transformation projects is a competent technical team that includes architects, analysts, testers, and engineers who can cover a wide range of development technologies. Indeed, the construction of modern architecture is associated with the freedom of their use, which allows us to reveal the strengths of a particular technology within a specific service.

In conclusion, we would like to say that it would be a mistake to think that the path to digital has an end. It is a way of constant changes, and to follow it you need to be prepared to invest, because the client is becoming pickier and more demanding, and competition is becoming more intense. But, if you look at the banks (JP Morgan, Sberbank, DBS, etc) that have successfully transformed their businesses and continue to do so, you will realize that they did it not in vain.