- Blockchain dApps: market overview

- dApp Blockchain basics

- Reasons for building dApps on blockchain

- What to consider while choosing the best blockchain for dApps

- Five potential routes examined

- Conclusion

The current moment is the best one to reflect on the future of dApps as a distinct business phenomenon in general and on the issues of building dApps on blockchain structure in particular. This segment of interest is relatively stable, after all. The never-ending crypto winter many industry players were afraid of a couple of years ago hasn’t come. On the other hand, blockchain hasn’t yet thoroughly revolutionized the world as many observers expected in the late 2010s. Something in-between is taking place. The domain is evolving gradually, in economic and technological terms. No major breakthroughs, no stagnation. Probably, this is the best environment to plunge into this concept.

In this situation, Andersen, in the capacity of a dApp development company, believes it is time to reflect on what the best niches for decentralized tools are now, what the best available blockchain options are for building them, and what your selection criteria might be.

Blockchain dApps: market overview

As of now, the recent developments associated with the market of blockchain dApps look promising. In late 2023, they were illustrated by the following facts and figures from DappRadar, the leading source of decentralized technology news and best insights:

- There were 15K+ dApps tracked across 64 chains (which is more than the 13K and 50 blockchains covered in 2022);

- Such a major blockchain industry health indicator as the daily Unique Active Wallets (also known as dAUW, i.e. those distinctive wallets interacting with the dApps’ smart contracts) exceeded 3.5 million. This is an obvious upward trend, if compared with the average level of almost 2.4 million back in 2022;

As for the most popular segments, one can approach this blockchain aspect from several dApp-focused angles, including this mobile banking research:

- In terms of unique active volumes, the best five domains were games with 1.3 million, exchanges with 670K, DeFi with 536K, marketplace with 384K, and collectibles with 341K;

- If one focuses on the actual number of transactions, the best performing niches are games with 10+ million, DeFi with 9+ million, exchanges with almost 3 million, marketplaces with 2.5+ million, and collectibles with roughly 1 million;

- Finally, let’s zoom in on the most lucrative ideas pertaining to dApp in blockchain in the context of the total amount of incoming value flowing to dApps’ smart contracts. The best results were achieved by exchanges with $5+ billion, DeFi with $2.6+ billion, marketplaces with $34+ million, games with $12 million, and collectibles with almost $9 million.

Blockchain in general and dApps in particular promise such breakthroughs as advanced personalization platform for banks, shared ownership of and control over content, greater freedom, end-user empowerment, i.e. all those characteristics that look best with social media, and these decentralized digital products do rank among the leaders.

dApp Blockchain basics

Having outlined the dominant market sentiment and situation, let’s take a step back and revisit some dApp blockchain basics, just in case. That would be the best step to take for an informative talk.

Distributed or decentralized applications differ significantly from their centralized counterparts in terms of ownership and operation patterns. Representatives of the latter are exclusively owned and overseen by a single actor, building upon its singular server or an entire cluster of servers.

In practical terms, when users download a centralized app, they have to universally rely on continuous communication with its designated server for proper functionality. This implies two consequences for end-users:

- Any technical issues or server crashes will inevitably result in the solution becoming non-functional until the problems are resolved. It is best to avoid such a calamity;

- Rules of engagement, standards of behavior, and event content itself, at the end of the day, are defined and managed by the company in charge.

In contrast, the building of decentralized apps on a blockchain network is continuous. Instead of traditional app downloads, users compensate developers with cryptocurrency to acquire a “smart contract.” This contract essentially consists of source code, which, when executed, generates an entirely new instance of the app on the user's device. This process is integral to the creation of a new block within the network.

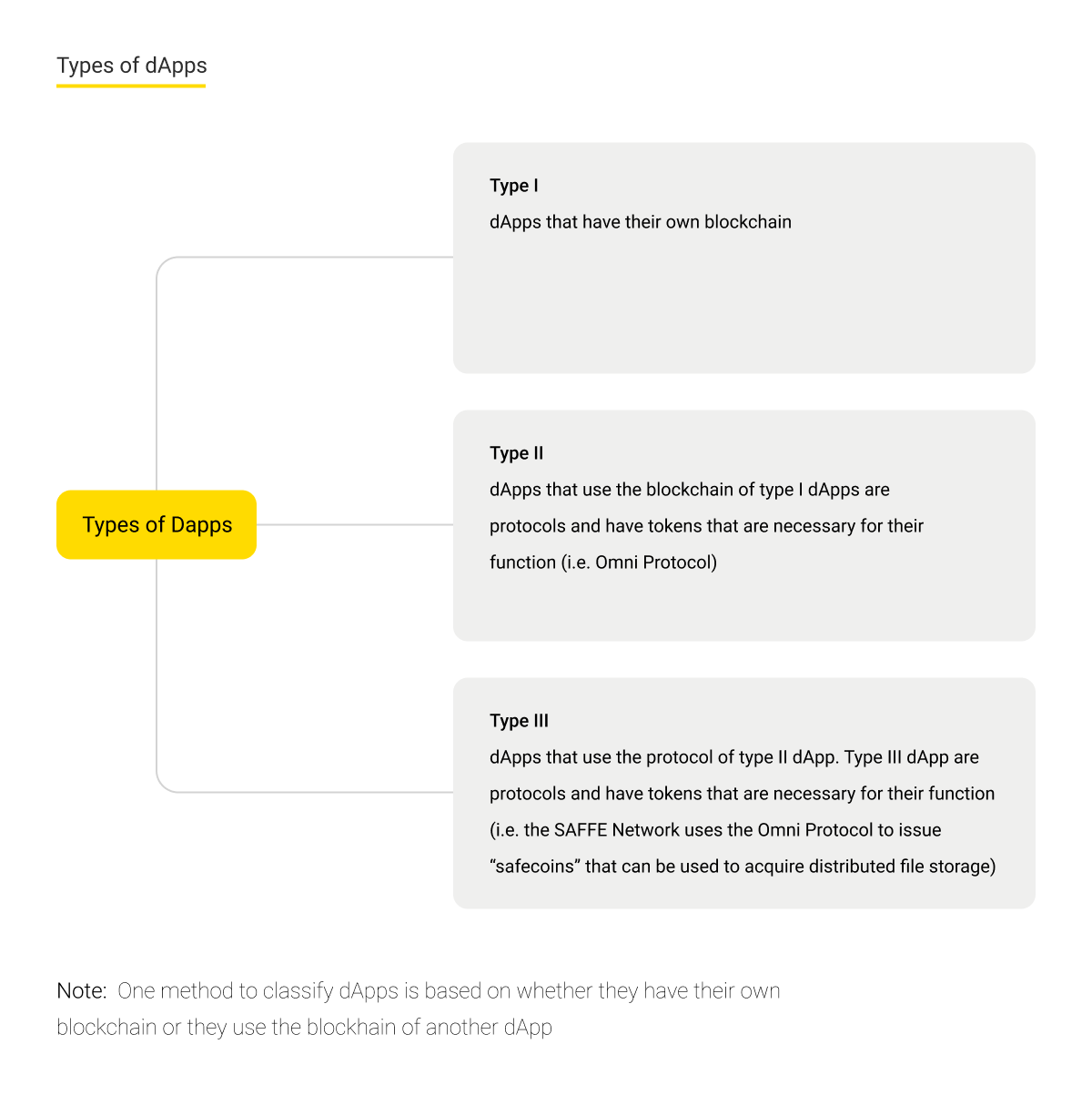

So, simply put, decentralized applications operate on peer-to-peer (P2P) blockchain networks rather than centralized servers. When categorizing them, they could be best classified into the following types:

- Type 1 employs its own “proprietary” blockchain protocol, such as BTC (which still serves as a de facto gold standard, which is clearly not the best pick for dApps);

- Type 2 functions as an additional layer built upon Type 1, aiming to enhance the efficiency of the foundational layer. An illustrative instance of this integration is the collaboration between the Lightning Network and the Bitcoin network. The Lightning Network supplements BTC, accelerating the speed of Bitcoin transactions;

- Type 3 utilizes a Type 2 app protocol. An example of a Type 3 dApp is the SAFE (Secure Access for All) network. This decentralized storage and communication network eliminates data centers and servers, replacing them with added computing resources for end-users. As an offline data network, it empowers end-users to construct censorship-resistant websites and apps. To realize this objective, it leverages the Omni Protocol (a BTC-based Type 2 layer) to issue SafeCoins, which, in turn, “fuel” its functionalities.

Reasons for building dApps on blockchain

When it comes to the rationales behind building dApps on blockchain (and, in broader terms, behind the ongoing gradual shift from web2 to web3), they can be best conceptualized as follows:

- Freedom from censorship which is a likely consequence of the control exerted by a single entity;

- Enhanced privacy protection, stemming from the decentralized foundations of blockchain. In essence, users do not need to entrust their sensitive information to any party to harness the capabilities of a dApp. This is probably the best feature for those preoccupied with privacy;

- Transparency is inherent, with all anonymized records being openly visible by default. As an outcome, any transaction can be scanned and verified;

- More flexible dApp engineering patterns, open-source in nature, practiced by the dApp community. Ideally, these models should be universally accessible for scrutiny, modification, and enhancement. While some dApps might still be semi-closed or fully closed, the degree of openness significantly impacts user adoption rates and the eventual success of any given project;

- If a blockchain network is technically adequate, it promises greater speed in comparison with customary banking options;

- Moreover, the facilitation of transactions among dApp users via smart contracts is a clear advantage, as such contracts are automatically executable. This is the best possible outcome for a user launching a transaction, i.e. when they know that the deal will be enforced in any case and under any circumstances.

What to consider while choosing the best blockchain for dApps

Not so long ago, Vitalik Buterin, the father of ETH, formulated the pivotal “Blockchain trilemma.” The latter refers to balancing the three key characteristics of any network: decentralization, security, and speed. There exists an obvious challenge in this respect.

On the one hand, it is self-evident that it would be best to have all three pillars in place. The problem, however, is that, as of now, one can enjoy only two of them. Indeed, these three aspects are interconnected in such a manner that improving one frequently leads to a reduction in another. This presents a considerable challenge for developers, who are often compelled to make trade-offs, sacrificing one aspect to enhance the other two.

Attempts are constantly being made to overcome this challenge. Yet, as of now, the problem persists. Below, you can see the top five blockchain alternatives in highest demand as of late 2023. Below, Andersen will scrutinize these best dApp blockchain alternatives.

Five potential routes examined

For building top blockchain dApps, any team must understand the specific requirements of their customer. These will influence what needs to be prioritized in the light of the blockchain trilemma and what this means for the building process.

So, here is our ranking of the best blockchain for dApps.

1. BNB. Best advantages and inevitable disadvantages

The Binance Chain, which has gained significant momentum recently, is characterized by centralization, yet it boasts remarkable transaction speeds. Views on its security vary, with some asserting its safety while skeptics express concerns about its centralized nature.

Its best merits for building include:

- Low transaction costs;

- Enhanced transaction speed compared to ETH, owing to lower congestion.

However, Binance has its drawbacks:

- Limited validators compared to ETH, leading to lower decentralization for dApps built on the platform;

- The relative scarcity of token owners poses challenges in promoting dApps.

2. ETH. Best advantages and understandable disadvantages

Ethereum stands out as another industry benchmark for dApp building initiatives, enjoying widespread popularity. However, it still falls short of resolving the blockchain trilemma, as it is decentralized, but not entirely secure and tends to be sluggish.

Its best strengths for building include:

- A comprehensive array of development tools, accessible models, and easily deployable functionalities;

- A substantial community committed to supporting the network;

- Reliability.

On the flip side, Ethereum has its building drawbacks, encompassing:

- Once again, sluggish transaction speeds;

- Elevated deployment costs;

- Dependence on the Proof-of-Work consensus, which adversely impacts operational efficiency.

3. Polygon. Best advantages and unavoidable disadvantages

Polygon offers scalability and cost-efficiency, making it an attractive solution for building dApps. However, concerns related to security and decentralization should be carefully considered. Let’s zoom in on the balance sheet in greater detail.

Credit points for building:

- Polygon, as a layer-2 option, addresses ETH's scalability issues with a sidechain framework, enhancing network throughput for faster transactions;

- Polygon's compatibility with ETH allows seamless integration with numerous dApps, offering web3 engineers flexibility and a broader user base;

- It boasts lower transaction costs than ETH, making it economically appealing for users and engineering teams. In addition, the factor of community support is also at play here.

Debit points for building:

- Despite inheriting security from ETH, sidechains on Polygon may cause concerns, dependent on their consensus mechanism and validator setup;

- Polygon's reliance on a set of validators may be perceived as less decentralized than ETH.

4. TRON. Best advantages and consequential disadvantages

TRON is seen by the web3 world as a centralized asset, since the community exercises little influence on blocks and transactions. On the other hand, it is incredibly fast and almost invincible.

Its best advantages for web3 building plans are:

- Great speed and an almost unprecedented number of transactions;

- Affordable transaction fees;

- Scalability and overall transparency.

Its building disadvantages include:

- As you might have already guessed, in the light of the Blockchain trilemma, TRON is overcentralized;

- Lack of transparency, as it is still not clear who controls the assets.

5. EOS. Best advantages and significant disadvantages

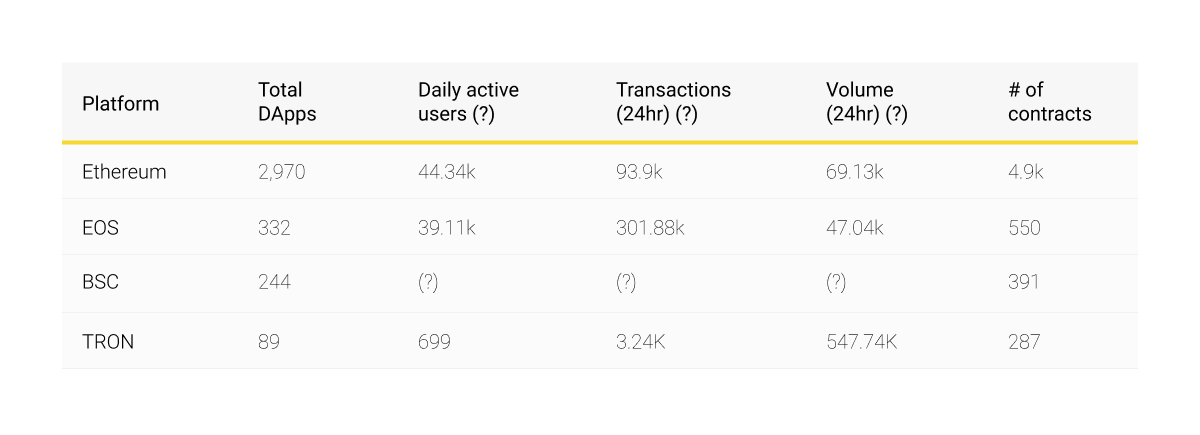

EOS is a secure and extremely fast option for building dispersed applications. However, as you can see in the table above, not so many web3 engineering teams actually vote for it with their investments and effort. There must be something in this “asset-and-liability” statement, discouraging companies.

At first sight, its building advantages look weighty:

- A high transaction speed;

- Almost no transaction fees, except for the requirement to stake some assets to deploy a contract;

- Voting opportunities make it possible to engage users to a greater extent.

However, it is not without critical shortcomings, when it comes to web3 building routines:

- Even seasoned blockchain engineers might experience difficulties while dealing with validation and staking issues;

- Your decentralized app may end up being centralized due to an insufficient circle of validators.

Conclusion

In conclusion, it would be best to repeat that choosing the best blockchain for dApps is a key determinant of your eventual building success. It is only you who is aware of the ideal balance between safety, extensibility, decentralization, community size, etc. for your unique web3 building purposes.

In case you find it hard to make the ultimate building decision, contact us at Andersen. As a team of professionals, we will apply both our profound knowledge and experience gained from real-world software building endeavors to assist with picking the right option and engineering your decentralized apps.